Churn Propensity

Churn propensity is calculated using a machine learning algorithm that models the relationships and interactions between a predetermined set of variables to predict a merchant’s likelihood of cancelling his/her account or becoming no-use.

Variables used in the model include:

- Customer demographics and pricing (i.e. the merchant's MCC industry)

- User behavior (i.e. level of engagement with CardPointe products)

- Support features (i.e. number of customer support tickets).

Our algorithm uses these variables to identify patterns and assign each merchant a churn probability score.

Churn Probability Scores

The model’s output (and any propensity model for that matter) is directional in nature. It cannot be determined with 100% certainty that a merchant with a high probability of churn will indeed cancel his/her account. However, through our testing and analysis, we’ve observed merchants with a score of 50% or higher are likely to churn at 7x the rate of merchants with lower scores.

Churn probability scores are most accurate at the time of scoring - the farther from the point of scoring, the more likely the variables at the time of scoring are no longer representative of the merchant’s current state.

Please keep in mind, a low probability score does not guarantee a merchant will not churn - the churn probability score implies the merchant's propensity to churn, not a certainty of whether he/she will or will not.

Please note: Seasonal merchants may have skewed scores. If you are aware that a merchant is seasonal, please use your best judgement when considering their score.

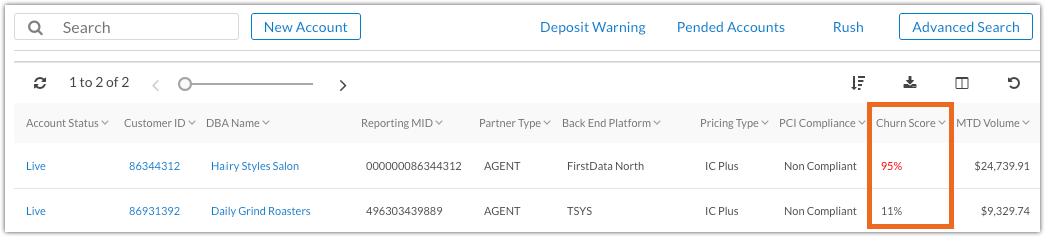

Customers Table

CoPilot's Customers Table includes a Churn Score column, which displays the merchant's estimated risk of cancelling or transitioning to another processor, based more than 40 risk factors.

Items to Note:

- Churn scores are updated on the first of every month using transaction data from the previous month - if you take action based on the scores, you’ll be able to monitor if your retention efforts have had an impact

- The score is shown as a percentage, with higher percentages (such as 99%) indicating the agent should engage the merchant to reduce the risk of churn

- Churn scores are not a definitive measure of the merchant's churn probability, but are a valuable indicator for merchants in higher risk categories